How To Register For Upbit Reddit

History and About

Upbit is a South Korean crypto commutation which released in Oct 2017. It was created by Korea'southward biggest messaging app developer, Kakao, providing 111 altcoins when it was launched.

Kakao Corp is more than just a giant internet company. The company's 'Kakao Talk' app is by far the biggest messaging awarding in Southward Korea. Kakao as well provides Korea's second nigh popular search engine, Daum, which is just behind Naver in terms of its overall traffic volume. The CEO behind the company, Song Chi-Hyung, is estimated to be worth around $500 one thousand thousand.

The company has recently been in the news for negative reasons, as information technology is currently nether investigation by Korean government over alleged charges of fraud. As information technology is the largest exchange in Southward Korea, these investigations have hit their crypto market, though the company maintains its innocence. To add to this, UpBit refused to join other exchanges in a self-regulatory body, causing some to question their motives.

UpBit is an exchange that offers single account trading with no leveraged trading options. It is exclusive to people who have established residency in Southward Korea, and then if you're from abroad you will non be able to annals. Furthermore, ID verification is essential. Those nether 19 are not permitted to make any trades.

Trading Pairs and Trading Volume

Upbit offers more than than 200 trading pairs, as information technology is in an active partnership with Bittrex. Every trading pair also those with Korean Won (KRW) is provided through Bittrex. Currently, the most popular traded pairs being ADA/KRW SNT/KRW and BTC/KRW.

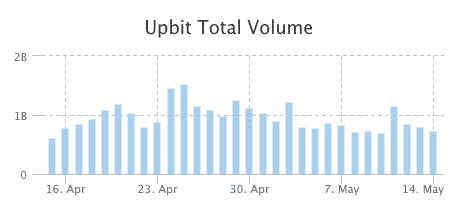

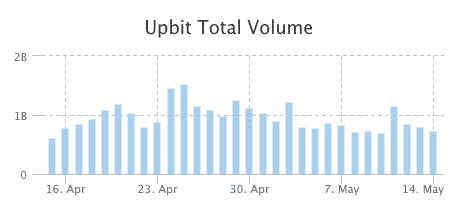

At press time, Upbit's trading book was at $734.9 million. Because it is such a big commutation, Upbit is allowed to merchandise in fiat in Due south Korea. However, Won is the only fiat currency that is currently supported.

UpBit was in operation for quite some fourth dimension before information technology publicly released trading volume data. This proved to exist controversial, as this was seemingly done to showcase major developments. Its big trading book allows for a high level of Liquidity Liquidity Liquidity is at the cadre of every broker'south offering. It is a basic characteristic of every financial asset - be information technology a currency, stock, bond, commodity or real manor. The more liquid an asset is, the easier it is to sell and purchase on the open up marketplace. Foreign exchange is considered to be the most liquid asset grade.Brokers can source liquidity from a single or multiple source, thereby delivering to their clients enough market depth for their orders to get filled. The primary feature of liquidity is its depth, which will determine how chop-chop and how big of an order can be executed via the trading platform.Understanding LiquidityLiquidity tin can be internal or external depending on the size and the book of the broker. Companies which are large enough and accept material client flows consistently are creating their ain liquidity pools from the club flow of their clients, thereby internalizing flows and saving on costs to transport customer orders to the interbank market. Past doing that however they are exposing themselves to carry the adventure on the trade.Liquidity providers can be prime brokers, prime number of primes, other brokers or the broker's book itself. Traditionally brokers are split between internalizing flows and offloading trades of their clients to different liquidity providers.Generally, retail brokers and their clients adopt more than liquid avails which lead to better fill rates and less slippage. When at that place is lack of liquidity on a sure market, slippage can occur - the social club is executed at a price which is the closest bachelor to the i requested by the client. Liquidity is at the core of every broker'southward offering. It is a basic characteristic of every financial asset - be it a currency, stock, bond, commodity or real estate. The more liquid an asset is, the easier information technology is to sell and buy on the open market. Foreign commutation is considered to be the most liquid asset class.Brokers tin can source liquidity from a single or multiple source, thereby delivering to their clients enough market place depth for their orders to become filled. The principal characteristic of liquidity is its depth, which will decide how chop-chop and how large of an guild tin can be executed via the trading platform.Understanding LiquidityLiquidity can be internal or external depending on the size and the book of the broker. Companies which are large enough and have fabric client flows consistently are creating their ain liquidity pools from the order flow of their clients, thereby internalizing flows and saving on costs to send customer orders to the interbank market. By doing that however they are exposing themselves to carry the risk on the trade.Liquidity providers can be prime brokers, prime of primes, other brokers or the broker's book itself. Traditionally brokers are separate between internalizing flows and offloading trades of their clients to different liquidity providers.Mostly, retail brokers and their clients prefer more liquid assets which lead to improve fill up rates and less slippage. When at that place is lack of liquidity on a sure market place, slippage can occur - the order is executed at a price which is the closest available to the one requested by the client. Read this Term which is cracking for users.

User Reputation and Customer Service

The commutation offers client support over email, past telephone, and besides through KakaoTalk, the app which is owned by Kakao. Upbit'due south client support resources have a generally good reputation with plenty of agents on manus to respond to inquiries or difficulties. An all-encompassing FAQ section is as well provided. They aim to get a response to the customers as quickly equally possible.

Upbit has had relatively possible feedback on Reddit, as they talk about the innovations that would happen for the exchange. Official contact details can likewise be found on twitter:

https://twitter.com/UPbitExchange/status/918629210255691777

Their KakaoTalk platform for answering Upbit-related questions can be institute here.

Security

UpBit provides several layers of security for users. First of all, users are required accept to be authenticated using legal forms of identification.

The exchange also uses 2-Factor Authentication. Upbit'southward online wallet security is provided by BitGo, recognized equally the prototype of multi-signature wallets and favored by many of the leading crypto exchanges worldwide.

Additional account security is provided past working with Kakao Pay, the mobile Payments Payments Ane of the bases of mediums of substitution in the modern globe, a payment constitutes the transfer of a legal currency or equivalent from ane party in exchange for goods or services to another entity. The payments manufacture has become a fixture of modern commerce, though the players involved and ways of exchange have dramatically shifted over time.In particular, a party making a payment is referred to as a payer, with the payee reflecting the individual or entity receiving the payment. Most commonly the basis of exchange involves fiat currency or legal tender, be it in the form of greenbacks, credit or bank transfers, debit, or checks. While typically associated with greenbacks transfers, payments tin can also be fabricated in anything of perceived value, be it stock or bartering – though this is far more express today than it has been in the past.The Largest Players in the Payments IndustryFor nigh individuals, the payments industry is dominated currently by card companies such as Visa or Mastercard, which facilitate the utilise of credit or debit expenditures. More recently, this industry has seen the ascent of Peer-to-Peer (P2P) payments services, which have gained tremendous traction in Europe, the United states, and Asia, among other continents.I of the biggest parameters for payments is timing, which looms as a crucial element for execution. Past this metric, consumer need incentivizes technology that prioritizes the fastest payment execution.This can help explain the preference for debit and credit payments overtaking cheque or money orders, which in previous decades were much more commonly utilized. A multi-billion-dollar industry, the payments space has seen some of the most innovation and advances in recent years as companies look to push contactless technology with faster execution times. 1 of the bases of mediums of exchange in the modern earth, a payment constitutes the transfer of a legal currency or equivalent from i party in commutation for goods or services to another entity. The payments manufacture has become a fixture of modern commerce, though the players involved and means of exchange have dramatically shifted over time.In item, a party making a payment is referred to as a payer, with the payee reflecting the individual or entity receiving the payment. Most unremarkably the ground of exchange involves fiat currency or legal tender, be it in the course of cash, credit or bank transfers, debit, or checks. While typically associated with cash transfers, payments can as well exist made in anything of perceived value, be it stock or bartering – though this is far more express today than it has been in the past.The Largest Players in the Payments IndustryFor almost individuals, the payments industry is dominated currently by card companies such as Visa or Mastercard, which facilitate the use of credit or debit expenditures. More recently, this industry has seen the ascension of Peer-to-Peer (P2P) payments services, which have gained tremendous traction in Europe, the U.s.a., and Asia, amidst other continents.One of the biggest parameters for payments is timing, which looms as a crucial chemical element for execution. Past this metric, consumer demand incentivizes technology that prioritizes the fastest payment execution.This tin can assist explain the preference for debit and credit payments overtaking cheque or money orders, which in previous decades were much more commonly utilized. A multi-billion-dollar industry, the payments space has seen some of the most innovation and advances in recent years every bit companies expect to push button contactless technology with faster execution times. Read this Term app which is owned by its partner Kakao Corp., which is a cardinal histrion on the South Korean market.

The Korea Fair Merchandise Commission has recently decided to put forrard legislation for the crypto marketplace. They've altered digital and financial laws, for example, to accost changing cryptocurrency markets.

They have also produced anti-money laundering regulations specifically created for Bitcoin. Both of these decisions came as a surprise to Bitcoin users in Korea.

Creating an Account

Accounts require electronic mail verification and identity authentication. Simply South Korean individuals tin can create an account, and institutional trading is supported. The length of time involved with ID verification varies, simply normally takes a couple of days to verify.

Payments are washed via credit cards or wire transfers. Mobile accounts are available for all those who use the service. For extra security, these applications are particularly effective as they're developed by the leading South Korean firm which specializes in this aspect.

There are no fees when it comes to setting upwardly an account, simply withdrawal fees apply when taking out sure types of currency which vary, depending on the currency. In that location are no fees for deposits any.

History and About

Upbit is a Due south Korean crypto exchange which released in October 2017. It was created past Korea's biggest messaging app programmer, Kakao, providing 111 altcoins when it was launched.

Kakao Corp is more just a giant internet company. The visitor'southward 'Kakao Talk' app is by far the biggest messaging awarding in Republic of korea. Kakao also provides Korea'south second most popular search engine, Daum, which is but behind Naver in terms of its overall traffic volume. The CEO behind the company, Song Chi-Hyung, is estimated to be worth effectually $500 million.

The visitor has recently been in the news for negative reasons, as it is currently under investigation by Korean authorities over alleged charges of fraud. As it is the largest exchange in South Korea, these investigations have hit their crypto market, though the visitor maintains its innocence. To add together to this, UpBit refused to join other exchanges in a cocky-regulatory trunk, causing some to question their motives.

UpBit is an exchange that offers single account trading with no leveraged trading options. It is exclusive to people who have established residency in South Korea, so if you're from away you will non be able to register. Furthermore, ID verification is essential. Those under xix are not permitted to make whatsoever trades.

Trading Pairs and Trading Volume

Upbit offers more than than 200 trading pairs, as it is in an active partnership with Bittrex. Every trading pair besides those with Korean Won (KRW) is provided through Bittrex. Currently, the most popular traded pairs being ADA/KRW SNT/KRW and BTC/KRW.

At press time, Upbit'due south trading book was at $734.9 million. Because it is such a large exchange, Upbit is allowed to trade in fiat in South Korea. Nevertheless, Won is the merely fiat currency that is currently supported.

UpBit was in operation for quite some fourth dimension before it publicly released trading volume data. This proved to be controversial, as this was seemingly done to showcase major developments. Its large trading volume allows for a loftier level of Liquidity Liquidity Liquidity is at the core of every broker's offering. Information technology is a basic characteristic of every financial asset - be it a currency, stock, bond, commodity or existent estate. The more liquid an nugget is, the easier it is to sell and buy on the open market. Foreign substitution is considered to be the most liquid asset class.Brokers can source liquidity from a single or multiple source, thereby delivering to their clients enough market depth for their orders to get filled. The primary characteristic of liquidity is its depth, which volition determine how chop-chop and how big of an guild can be executed via the trading platform.Understanding LiquidityLiquidity tin can be internal or external depending on the size and the volume of the broker. Companies which are large plenty and have material customer flows consistently are creating their own liquidity pools from the order flow of their clients, thereby internalizing flows and saving on costs to ship customer orders to the interbank marketplace. By doing that nevertheless they are exposing themselves to bear the risk on the trade.Liquidity providers can be prime number brokers, prime number of primes, other brokers or the broker's book itself. Traditionally brokers are split between internalizing flows and offloading trades of their clients to dissimilar liquidity providers.Generally, retail brokers and their clients adopt more liquid assets which pb to improve fill rates and less slippage. When there is lack of liquidity on a sure market, slippage tin can occur - the order is executed at a price which is the closest bachelor to the one requested past the client. Liquidity is at the cadre of every broker's offer. It is a bones characteristic of every financial asset - exist it a currency, stock, bond, article or real manor. The more than liquid an nugget is, the easier it is to sell and buy on the open market. Foreign exchange is considered to be the about liquid asset class.Brokers tin can source liquidity from a single or multiple source, thereby delivering to their clients enough market depth for their orders to get filled. The main feature of liquidity is its depth, which will determine how quickly and how big of an order can be executed via the trading platform.Agreement LiquidityLiquidity tin can be internal or external depending on the size and the book of the broker. Companies which are large plenty and have cloth client flows consistently are creating their own liquidity pools from the order flow of their clients, thereby internalizing flows and saving on costs to transport customer orders to the interbank market. Past doing that however they are exposing themselves to carry the risk on the trade.Liquidity providers tin exist prime brokers, prime of primes, other brokers or the banker's volume itself. Traditionally brokers are split between internalizing flows and offloading trades of their clients to different liquidity providers.Generally, retail brokers and their clients adopt more liquid assets which atomic number 82 to better fill rates and less slippage. When there is lack of liquidity on a certain market, slippage tin can occur - the order is executed at a price which is the closest available to the ane requested by the client. Read this Term which is great for users.

User Reputation and Customer Service

The exchange offers client back up over email, past telephone, and also through KakaoTalk, the app which is owned by Kakao. Upbit's customer support resources have a generally good reputation with plenty of agents on hand to answer to inquiries or difficulties. An extensive FAQ section is too provided. They aim to get a response to the customers equally quickly as possible.

Upbit has had relatively possible feedback on Reddit, equally they talk about the innovations that would happen for the substitution. Official contact details can also be found on twitter:

https://twitter.com/UPbitExchange/status/918629210255691777

Their KakaoTalk platform for answering Upbit-related questions tin be establish here.

Security

UpBit provides several layers of security for users. First of all, users are required take to be authenticated using legal forms of identification.

The exchange likewise uses 2-Cistron Authentication. Upbit's online wallet security is provided by BitGo, recognized as the epitome of multi-signature wallets and favored by many of the leading crypto exchanges worldwide.

Additional account security is provided past working with Kakao Pay, the mobile Payments Payments One of the bases of mediums of exchange in the modern earth, a payment constitutes the transfer of a legal currency or equivalent from one political party in commutation for goods or services to some other entity. The payments industry has become a fixture of modern commerce, though the players involved and means of exchange take dramatically shifted over time.In particular, a party making a payment is referred to as a payer, with the payee reflecting the private or entity receiving the payment. Nigh normally the basis of exchange involves fiat currency or legal tender, exist it in the class of cash, credit or banking company transfers, debit, or checks. While typically associated with cash transfers, payments tin also be made in anything of perceived value, exist it stock or bartering – though this is far more than limited today than it has been in the by.The Largest Players in the Payments IndustryFor near individuals, the payments industry is dominated currently by card companies such as Visa or Mastercard, which facilitate the utilize of credit or debit expenditures. More recently, this manufacture has seen the ascension of Peer-to-Peer (P2P) payments services, which take gained tremendous traction in Europe, the United States, and Asia, amidst other continents.One of the biggest parameters for payments is timing, which looms as a crucial element for execution. Past this metric, consumer demand incentivizes applied science that prioritizes the fastest payment execution.This tin can assist explain the preference for debit and credit payments overtaking check or coin orders, which in previous decades were much more than usually utilized. A multi-billion-dollar manufacture, the payments space has seen some of the most innovation and advances in contempo years as companies look to push contactless applied science with faster execution times. One of the bases of mediums of exchange in the mod world, a payment constitutes the transfer of a legal currency or equivalent from ane party in exchange for goods or services to another entity. The payments industry has become a fixture of modern commerce, though the players involved and ways of substitution accept dramatically shifted over time.In item, a party making a payment is referred to as a payer, with the payee reflecting the individual or entity receiving the payment. Most commonly the basis of substitution involves fiat currency or legal tender, be it in the form of cash, credit or banking concern transfers, debit, or checks. While typically associated with cash transfers, payments can too be fabricated in anything of perceived value, be it stock or bartering – though this is far more than express today than it has been in the past.The Largest Players in the Payments IndustryFor most individuals, the payments industry is dominated currently by card companies such as Visa or Mastercard, which facilitate the apply of credit or debit expenditures. More than recently, this manufacture has seen the rise of Peer-to-Peer (P2P) payments services, which take gained tremendous traction in Europe, the The states, and Asia, among other continents.I of the biggest parameters for payments is timing, which looms as a crucial chemical element for execution. By this metric, consumer demand incentivizes technology that prioritizes the fastest payment execution.This tin help explain the preference for debit and credit payments overtaking check or money orders, which in previous decades were much more than normally utilized. A multi-billion-dollar industry, the payments infinite has seen some of the most innovation and advances in recent years every bit companies look to push contactless technology with faster execution times. Read this Term app which is owned by its partner Kakao Corp., which is a key player on the South Korean market.

The Korea Fair Merchandise Committee has recently decided to put forward legislation for the crypto market. They've altered digital and fiscal laws, for instance, to address changing cryptocurrency markets.

They have too produced anti-money laundering regulations specifically created for Bitcoin. Both of these decisions came as a surprise to Bitcoin users in Korea.

Creating an Account

Accounts require email verification and identity authentication. Just South Korean individuals can create an account, and institutional trading is supported. The length of time involved with ID verification varies, but ordinarily takes a couple of days to verify.

Payments are done via credit cards or wire transfers. Mobile accounts are bachelor for all those who use the service. For actress security, these applications are peculiarly constructive as they're developed past the leading Southward Korean house which specializes in this aspect.

There are no fees when it comes to setting upwardly an account, but withdrawal fees apply when taking out sure types of currency which vary, depending on the currency. There are no fees for deposits whatsoever.

Source: https://www.financemagnates.com/cryptocurrency/education-centre/everything-need-know-upbit/

Posted by: oliveyespire.blogspot.com

0 Response to "How To Register For Upbit Reddit"

Post a Comment